4.9.6.10 Splitting of income streams - overview

Summary

The Family Law Act 1975 allows superannuation interests to be split pursuant to a divorce property settlement. These changes may impact on income streams purchased or acquired from a superannuation fund, or purchased as an annuity from a life office or friendly society with superannuation or non-superannuation money.

This topic covers:

- summary of changes

- income streams splits in the payment phase

- payout in full of non-member's interest

- operative time, and

- concept of NPP.

Act reference: SSAct section 9C Family law affected income streams

Summary of changes

The separating parties in a property settlement are designated as the member (1.1.M.118) and the non-member (1.1.N.115).

The following rules for assessment, found in 4.9.6.20 to 4.9.6.100, apply to income streams that have arisen as a consequence of:

- a payment split under the Family Law Act Part VIIIB, or

- an order under the Family Law Act Part VIIIAA.

Income streams splits in the payment phase

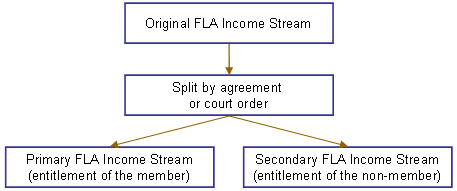

Income streams that are to be split pursuant to a divorce property settlement are designated as original FLA income streams (1.1.O.35). Original FLA income streams are acquired or purchased by the member from a superannuation fund or through the purchase of an annuity from a life office or friendly society (SSAct section 9C). The income streams are split between the member and the non-member in accordance with a superannuation agreement (1.1.S.416) or court order (1.1.C.355).

Ongoing payments resulting from the splitting order and paid to:

- the member is called the primary FLA income stream (1.1.P.385), and

- the non-member is called the secondary FLA income stream (1.1.S.65).

The original, primary and secondary FLA income streams are collectively called family law affected (FLA) income streams (1.1.F.50).

The diagram below indicates the resulting income streams that need to be assessed under the income and assets test.

The original FLA income stream, and the primary and secondary FLA income streams are referred to respectively as the original FLA, the primary FLA and the secondary FLA.

In assessing split income streams, the basic principle is that the income stream payments, the asset value, and the deduction amount applying to the continuing income streams payments will be split between the member and non-member in the proportions resulting from the superannuation agreement or court order.

Income stream payments can be split as either a 'percentage payment split' (1.1.P.175) or a 'base amount payment split' (1.1.B.05).

Payout in full of non-member's interest

Before the 'first split' income stream payment is made, the trustee of the superannuation fund or, if the income stream is sourced from a retirement savings account (1.1.R.260), a life office, or friendly society, the provider holding the original FLA income stream may exercise discretion under regulation 14G of the Family Law (Superannuation) Regulations 2001 to pay out in full the entitlement of the non-member. The payout can apply to either a percentage payment split or a base amount payment split.

Payouts can be made by:

- creating a new interest (income stream) in favour of the non-member with a value equivalent to that specified to in the superannuation agreement or court order

- transferring or rolling over an amount equivalent to that specified to in the superannuation agreement or court order to another fund or retirement savings account, to be held for the non-member, or

- paying a lump sum to the non-member equivalent to that specified to in the superannuation agreement or court order.

In each case above, the non-member is not entitled to any further payments.

Operative time

Where the payments from an income stream are split pursuant to a divorce property settlement, any assessment of the split payments will commence from the operative time (1.1.O.25).

If the operative time is not specified in a court order, it will be necessary to ascertain from the trustee when the first split of payments will occur. The assessment of the split payments will commence from the first day of the period to which the first split payment relates.

Concept of NPP

Topics 4.9.6.20 to 4.9.6.55 make use of the term 'notional purchase price' (1.1.N.135). The reason for the use of this term is as follows.

The purchase price (1.1.P.500) as defined in the SSAct reduces the purchase price at the commencement day of an income stream by any commutations that are made from the income stream. Accordingly, the purchase price for an income stream may vary at different points in time. For example, if a series of commutations occurs during the life of the income streams, the income stream will have a different purchase price after each commutation has occurred. For this reason, it is important to clearly identify the point in time when the income stream is being assessed. Failure to do this may result in the use of an incorrect value for the purchase price of the income stream.